how much is inheritance tax in nc

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. The inheritance tax of another state may come into play for.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

There is no inheritance tax in NC.

. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. Bank accounts certificates of deposit and investment. North Carolina does not collect an inheritance tax or an estate tax.

1-800-959-1247 email protected 100 Fisher Ave. Very few people now have to pay these taxes. The legal process of dealing with a decedents estate in North Carolina is known as probate.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money. North Carolina does not collect an inheritance tax or an estate tax.

Iowa Extended family pays a 5 percent tax on the first 12500 of the inheritance and up to 10 percent of estates worth over 150000. There is no inheritance tax in North Carolina. North Carolina Inheritance Tax and Gift Tax.

A surviving spouse is the only person exempt from paying this tax. However state residents should remember to take into account the federal estate tax if. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in.

Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo. North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. Inheritance taxes are levied on heirs after they have received money from the deceased.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. North Carolina has a flat income tax of 525. A surviving spouse is the only person exempt from paying this tax.

North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. How Much is Inheritance Tax. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

Anything higher than 5 above that number however and your beneficiaries are paying taxes up to 16 in New York inheritance tax on the entire amount of the inheritance. All inheritance are exempt in the state of north carolina. In 2021 federal estate tax generally applies to assets over 117 million.

The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. However there are 2 important exceptions to this rule. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

North Carolina Inheritance Tax and Gift Tax. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. An inheritance tax is usually paid by a person inheriting an estate.

The legal process of dealing with a decedents estate in North Carolina is known as probate. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million. 7 To limit the liability of paying hundreds of thousands of dollars in the New York inheritance tax upon death these harsh tax rules necessitate strategic inheritance planning.

The inheritance tax rate in north carolina is 16 percent at the most according to nolo. If you inherit property in Kentucky for example that states. How Long Does It Take to Get an Inheritance.

The major difference between estate tax and inheritance tax is who pays the tax. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. There is no federal inheritance tax but there is a federal estate tax.

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. 5 rows How Much Tax Do You Pay On Inheritance In Nc. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40.

For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance. Learn North Carolina income tax property tax rates and sales tax to estimate how much youll pay on your 2021 tax return. However there are sometimes taxes for other reasons.

Federal Gift Tax Vs California Inheritance Tax

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina State Taxes 2022 Tax Season Forbes Advisor

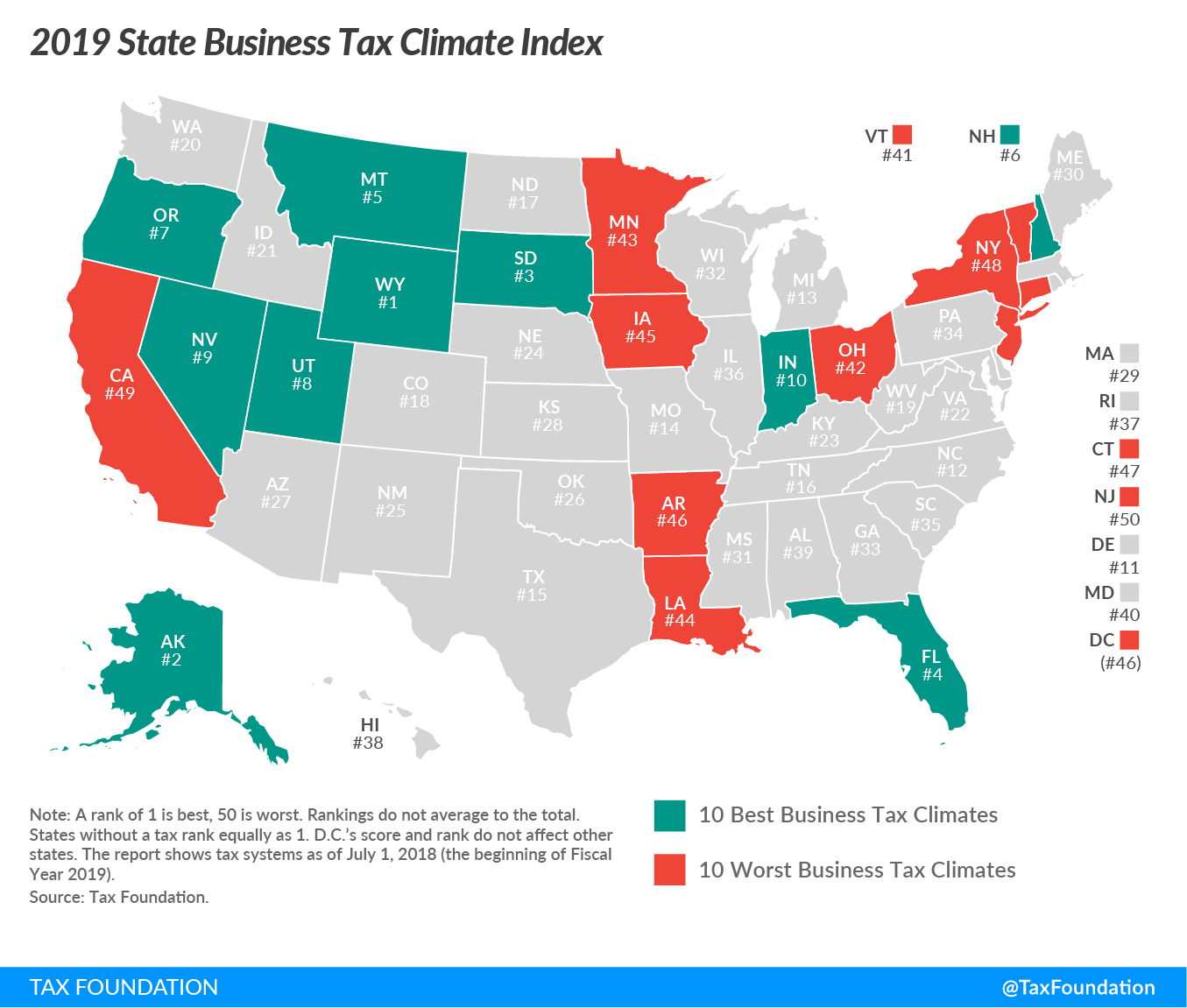

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Searching For Lower Taxes Check State Laws Legacy Planning Law Group

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Estate Tax Everything You Need To Know Smartasset

Historical North Carolina Tax Policy Information Ballotpedia

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

How Can I Mitigate My Children Paying Taxes On My Estate In Raleigh When I M Gone

States With No Estate Tax Or Inheritance Tax Plan Where You Die

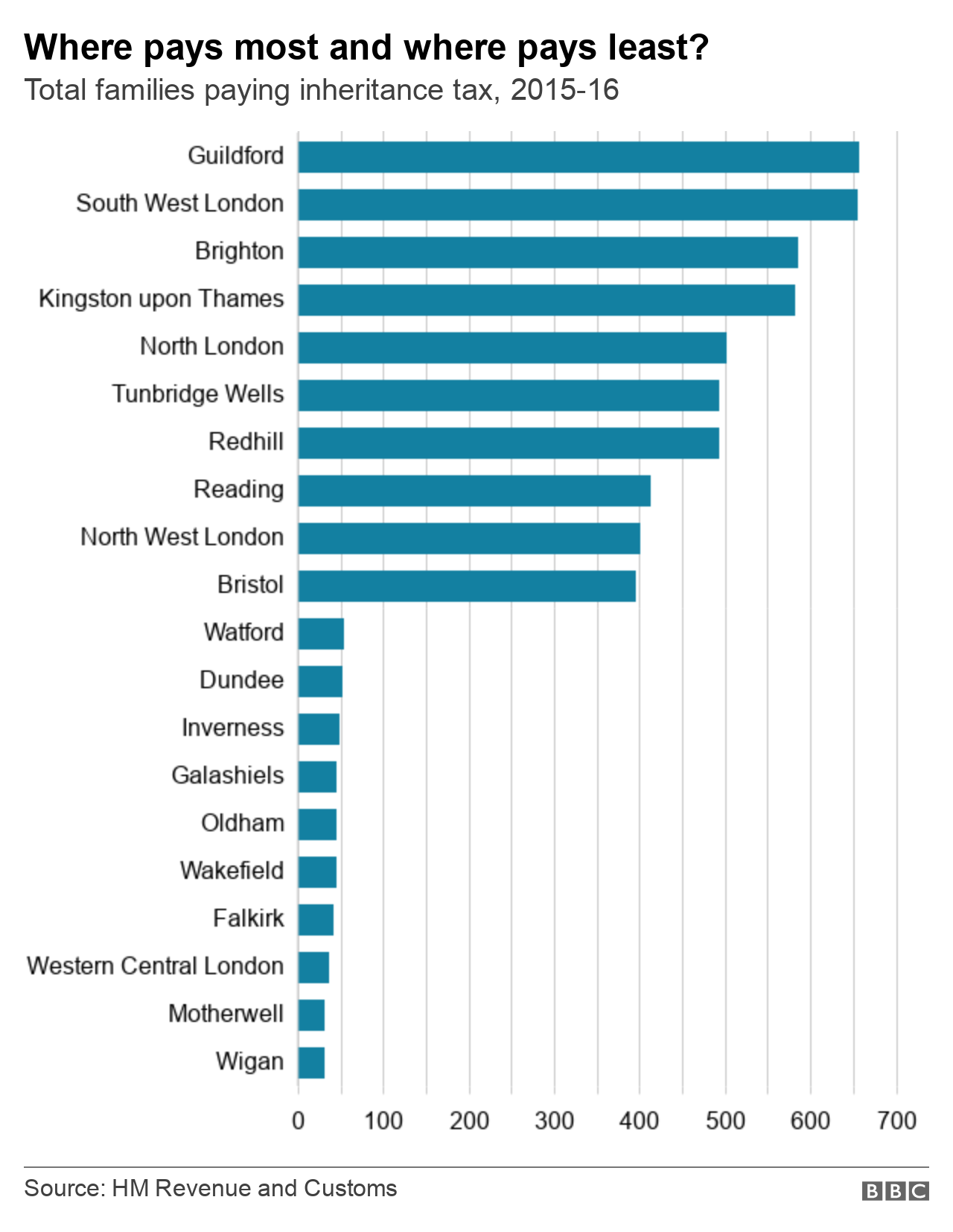

Guildford Is The Inheritance Tax Capital Of The Uk Bbc News

States With Highest And Lowest Sales Tax Rates

What North Carolina Residents Need To Know About Federal Capital Gains Taxes